As the digital gold rush for artificial intelligence continues to reshape global markets, the focus is intensifying on the critical yet often overlooked infrastructure—the high-speed networking that forms the very backbone of AI innovation. In this high-stakes environment, Arista Networks has emerged as a pivotal player, its stock becoming a key barometer for the health and trajectory of the entire AI ecosystem. With the company’s latest closing price at $131.84, investors are closely analyzing the confluence of market dynamics, technological advancements, and financial performance that will dictate its path as the final trading days of the year unfold. The story of Arista is no longer just about network switches; it is about providing the essential circulatory system for the data-hungry brains of modern AI, a position that brings both immense opportunity and significant scrutiny.

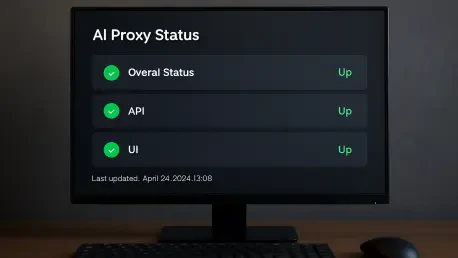

1. The Market Pulse and Arista’s AI Proxy Status

The current market environment heading into the year’s end is uniquely influential for a company like Arista Networks, whose stock often trades not just on its own merits but as a proxy for the broader artificial intelligence and growth sectors. Late December trading sessions are historically characterized by lighter volumes, a factor that can magnify price movements in large-cap stocks as institutional investors rebalance their portfolios. Following a quiet, post-holiday session where major indexes hovered near record highs, the market appears to be in a consolidation phase. Market strategists have noted that this period represents a “breather” after a substantial rally, with the potential for a “Santa Claus rally” still in play. Investors are keenly watching macroeconomic indicators, including upcoming Federal Reserve minutes and ongoing debates about the future path of interest rates in 2026, which will heavily influence sentiment toward growth-oriented technology stocks. This backdrop is crucial for Arista, as its identity as a prime beneficiary of AI infrastructure spending means its valuation is deeply intertwined with investor confidence in the durability of this technological wave.

This sensitivity is clearly reflected in Arista’s valuation metrics and how the market perceives them. With a market capitalization of approximately $183 billion and a trailing price-to-earnings ratio in the mid-50s, the stock carries the premium valuation typical of a high-growth leader. However, this “rich valuation” is a double-edged sword. While it signals strong investor belief in the company’s future, it also makes the stock susceptible to heightened volatility. Any hint of a slowdown in AI-related capital expenditures from its major clients can trigger disproportionate swings in the stock price. Recent market analysis has highlighted this very point, with commentators flagging the elevated forward price-to-sales multiple compared to its industry peers. While upward revisions to earnings estimates have provided a bullish signal, the high expectations embedded in the current stock price mean that Arista must consistently deliver exceptional results and optimistic guidance to justify its premium and fend off concerns about potential multiple compression should growth moderate.

2. Core Catalysts Fueling Growth

At the heart of Arista Networks’ current momentum is its strategic positioning within the AI data center buildout, where its technology serves a function as vital as the GPUs that power the computations. If GPUs are the “brains” of an AI cluster, Arista’s high-performance networking equipment is the “circulatory system,” responsible for moving massive datasets with minimal delay. A significant product catalyst driving this narrative is the company’s R4 Series platforms, a next-generation portfolio of 800G routing and switching systems specifically engineered for the demanding environments of AI fabrics and hyperscale data centers. Announced in late October, these platforms include dense 800 Gbps systems and innovative “HyperPorts” designed to dramatically increase capacity and performance. This launch was timely, aligning with projections of rapid growth in the 800GbE market. According to Crehan Research, Arista has already established itself as the branded market share leader in both 800GbE and overall data center Ethernet switching, placing it in an ideal position to capture a significant portion of the multi-year investment cycle driven by AI and cloud workloads.

This technological leadership is directly translating into impressive financial execution, reinforcing the bull case for the company. In its third-quarter report for 2025, Arista posted robust results that surpassed expectations, showcasing revenue of $2.308 billion, a remarkable 27.5% increase year-over-year. This top-line growth was accompanied by strong profitability, with non-GAAP earnings per share rising to $0.75 and GAAP net income reaching $853.0 million. During the earnings call, CEO Jayshree Ullal emphasized the success of Arista’s “centers of data” strategy, which is resonating with a wide range of customers looking to build seamless connectivity from campus environments to the cloud and specialized AI centers. The company’s forward-looking guidance and its long-range revenue ambition for fiscal year 2026 remain a central focus for investors, who continue to benchmark Arista’s trajectory against these ambitious targets. While the company has projected strong growth, the market remains vigilant, weighing these forecasts against the backdrop of intensifying competition in the AI networking space from other large, well-funded players.

3. Strategic Expansion and Future Trajectory

While Arista’s success has been largely built on its deep relationships with a handful of hyperscale data center operators, a key and often underappreciated part of its long-term strategy involves a deliberate expansion into the enterprise market. This strategic pivot is designed to diversify its revenue streams and reduce its reliance on the cyclical capital expenditure budgets of its largest customers. A cornerstone of this initiative was the July 2025 acquisition of Broadcom’s VeloCloud SD-WAN portfolio. This move significantly bolsters Arista’s capabilities in campus and branch networking, filling a critical gap in its product lineup and enabling it to offer a more comprehensive client-to-cloud architecture. The integration of VeloCloud is seen as a crucial step in strengthening Arista’s position in the growing SD-WAN and Secure Access Service Edge (SASE) markets. For investors, this enterprise-focused “second act” is significant because it opens up a vast new addressable market and creates a more resilient and diversified growth profile for the company over the long term.

The forward-looking view from Wall Street analysts largely reflects optimism about Arista’s dual strategy of dominating AI networking while simultaneously expanding its enterprise footprint. Consensus price targets from various financial platforms suggest a potential double-digit percentage upside from its current trading level of around $132. For instance, data aggregated from MarketBeat and TipRanks shows average 12-month price targets clustering in the $163 to $169 range, with the majority of analysts maintaining a “buy” rating. These forecasts are underpinned by the belief that Arista’s best-in-class technology and strong execution will allow it to continue capturing a disproportionate share of the AI networking market. However, not all analysts are uniformly bullish. Some, like Rosenblatt Securities, have reiterated a more cautious “Hold” rating with a $140 price target, serving as a reminder that risks remain. Investors treat these targets not as guarantees but as gauges of sentiment, knowing that they can shift rapidly based on earnings reports, macroeconomic changes, or signals regarding hyperscaler spending plans. The next earnings release, tentatively expected around mid-February 2026, will be a critical event that resets the narrative and provides clarity on the company’s trajectory.

4. Navigating Headwinds and Investor Risks

Despite Arista’s strong market position and compelling growth story, investors remain acutely aware of several key risks that could impact the stock’s performance. Chief among these is customer concentration. Historically, a significant portion of Arista’s revenue has come from a small number of hyperscale giants, including Meta and Microsoft. This symbiotic relationship has been incredibly lucrative during periods of aggressive AI infrastructure buildouts, but it also creates vulnerability. Any pause, delay, or reduction in capital expenditures from these major customers could have an outsized negative impact on Arista’s top-line growth and investor sentiment. This risk is not merely theoretical; the market has previously reacted to broader concerns about a potential slowdown in AI spending, and such narrative shifts can drag down stocks like Arista even in the absence of company-specific negative news. The company’s future success will depend on its ability to navigate these spending cycles while simultaneously growing its enterprise business to create a more balanced customer base.

Beyond customer-specific risks, Arista operates in a fiercely competitive and rapidly evolving technological landscape. The AI networking space is attracting massive investment from both established incumbents and nimble specialists, all vying for a piece of this high-growth market. Competitors are aggressively developing their own Ethernet-based solutions for AI scale-out and scale-up networking, which could lead to increased pricing pressure and margin erosion over time. Even if overall demand for AI networking remains robust, Arista will need to continue innovating at a rapid pace to maintain its technological edge and market share. Compounding this competitive pressure is the valuation risk inherent in the stock. Having been priced for sustained, high-level growth, Arista faces the challenge of constantly meeting or exceeding lofty market expectations. A scenario where the company delivers “good” but not “great” results, or provides guidance that is merely in line with rather than above consensus, could still trigger a significant sell-off as investors recalibrate their growth models. This dynamic ensures that valuation will remain a key driver of volatility for the foreseeable future.

5. The Bellwether’s Year-End Stance

Arista Networks concluded the trading week as a definitive bellwether for the AI infrastructure sector, its stock embodying the immense promise and inherent volatility of the current technological boom. Its position was solidified by clear product leadership in the critical 800G networking segment, a market essential for building next-generation AI data centers. This technological advantage was validated by a strong third-quarter financial performance that showcased robust revenue growth and profitability. However, this success was set against a market backdrop that, while broadly constructive, remained highly sensitive to macroeconomic factors like interest rate expectations and the unique dynamics of year-end portfolio adjustments. The company’s premium valuation stood as a testament to investor confidence but also served as a constant source of pressure, making the stock a high-conviction holding that demanded flawless execution.

As investors looked toward the final trading sessions of 2025, the central question revolved around whether the market would continue to reward AI infrastructure plays with the same fervor seen in previous months. The situation required a nuanced approach, separating the powerful, long-term AI narrative from the quarter-to-quarter realities of Arista’s execution, competitive pressures, and customer spending cycles. Practical considerations for the upcoming week included monitoring the macroeconomic calendar for any news that could shift sentiment on growth stocks and watching for any company-specific headlines or SEC filings that might emerge. Ultimately, Arista’s stock performance in the closing days of the year depended on its ability to trade less like a high-multiple mood ring, fluctuating with every market whim, and more like a high-conviction compounder, reflecting the fundamental strength of its technology and strategic vision.