What happens when the sun-drenched shores of the Mediterranean become the beating heart of Europe’s digital revolution, transforming cities like Marseille, Barcelona, Genoa, and Crete into key players? In these coastal regions, a profound shift is unfolding that could redefine how data powers the continent. Data centers in these areas are rapidly emerging as critical nodes, handling vast streams of information that fuel everything from AI to global commerce. This isn’t just a tech story—it’s a glimpse into a seismic shift where geography, sustainability, and connectivity collide to create unexpected powerhouses.

The significance of this trend lies in its far-reaching impact on Europe’s digital economy. As traditional hubs like Frankfurt and Paris grapple with power constraints and high costs, Mediterranean cities are stepping up with strategic advantages that make them indispensable. Their coastal locations link continents through subsea cables, while a push for green energy aligns with stringent EU regulations. This surge represents more than infrastructure growth; it’s about ensuring digital equity and resilience in a hyper-connected world.

Why Mediterranean Cities Are Rising as Digital Powerhouses

In the race to dominate Europe’s digital landscape, Mediterranean cities are proving to be dark horses. Their unique position as gateways between Europe, Africa, Asia, and the Middle East offers unparalleled connectivity. Subsea cables landing on their shores facilitate low-latency data transfers, making these locations vital for cloud services and real-time applications that power modern economies.

Beyond geography, there’s a growing recognition of their potential to address critical challenges. With data demand skyrocketing—projected to increase by 30% annually through 2027—traditional hubs are struggling to keep pace. Mediterranean markets offer a solution, combining untapped capacity with a commitment to innovation, positioning them as essential players in the continent’s tech ecosystem.

This rise also reflects a broader shift in priorities. Operators are drawn to these regions not just for space, but for their ability to support sustainable growth. As environmental concerns mount, the focus on renewable energy in these cities sets a benchmark for balancing digital expansion with ecological responsibility.

The Strategic Importance of Mediterranean Data Centers

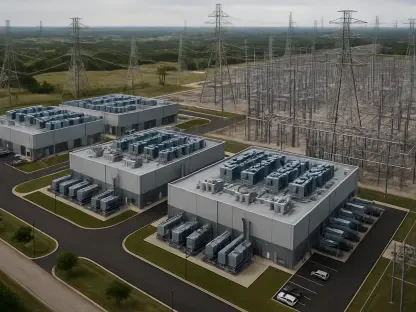

The Mediterranean’s ascent as a digital hub is rooted in its role as a crossroads for global data traffic. Cities like Marseille, with 58 MW of live IT capacity, and Barcelona, boasting 63 MW, are becoming linchpins for intercontinental connectivity. Their ports serve as landing points for major cable systems like 2Africa and BlueMed, ensuring seamless data flow across regions.

This strategic edge is amplified by the region’s ability to cater to hyperscale providers. Giants like Microsoft and Google are eyeing markets such as Crete for expansion, drawn by lower energy costs and political stability. These factors make the area a hotspot for meeting the escalating needs of AI processing and content delivery networks.

Moreover, the Mediterranean’s growth highlights a pivot toward secondary markets. Unlike saturated centers in Northern Europe, these cities offer room for scalable infrastructure. This trend signals a reimagining of where and how digital resources are allocated, with implications for economic development and global tech equity.

Key Markets Driving the Mediterranean Data Center Boom

Diving into the specifics, four standout markets are shaping this digital wave, each with distinct strengths. Marseille leads as a connectivity titan, handling 12 active subsea cable landings and dominating with facilities operated by major players like Digital Realty. Yet, local pushback against expansions like the MRS6 project reveals the delicate balance between growth and community sentiment.

Barcelona, meanwhile, is carving a niche as an AI-ready hub with 63 MW of IT power and ambitious projects like the Medloop cable. Its emphasis on sustainability, exemplified by operators like AQ Compute running entirely on renewables, positions it as a model for green infrastructure. This focus attracts hyperscale clients seeking eco-friendly solutions.

Genoa acts as a crucial bridge, linking to Milan and global routes through cables like BlueMed. Facilities such as Equinix’s GN1 underscore its role in regional data ecosystems, while Crete emerges as a rapid riser with a staggering 60% capacity growth in recent metrics. With upcoming systems like the East-to-Med Corridor, it’s becoming a magnet for tech giants, bolstered by low-cost energy and stable governance.

Industry Insights and Ground-Level Perspectives

Voices from the field paint a vivid picture of this transformation. According to recent data from industry analysts, Crete’s capacity growth outstrips Marseille’s 27% increase by more than double, signaling a tilt toward emerging markets. A representative from Digital Realty commented, “Navigating local concerns while expanding in Marseille remains a complex hurdle,” shedding light on the friction between progress and public opinion.

In Barcelona, the push for sustainability is tangible. Operators are locking in power purchase agreements for solar and wind energy, with AQ Compute setting a precedent for fully green facilities. This move not only aligns with EU goals but also appeals to environmentally conscious investors, showcasing a practical approach to growth.

These perspectives are grounded in real challenges and innovations. From Genoa’s strategic cable connections boosting latency performance to Crete’s allure for major tech firms, the blend of data and firsthand accounts reveals a region at a crossroads—poised for expansion yet mindful of the stakes involved.

Strategies for Sustainable Growth in Mediterranean Hubs

Looking ahead, a clear roadmap is essential for sustaining this momentum. Engaging local communities stands out as a priority—transparent dialogue, as needed in Marseille, can mitigate opposition. Hosting public forums and sharing detailed environmental plans build trust, ensuring projects move forward without friction.

Investment in renewable energy is another cornerstone. Following the lead of Barcelona and Crete, securing solar and wind through long-term agreements aligns with Europe’s green mandates. This not only reduces carbon footprints but also enhances market appeal for eco-focused tech companies.

Lastly, ensuring power availability and leveraging connectivity assets are critical. Markets like Crete thrive on reliable, affordable energy, a key factor for hyperscale site selection. Meanwhile, promoting subsea cable hubs like Genoa as low-latency centers can attract global providers, cementing the Mediterranean’s role in Europe’s digital future.

Reflecting on this remarkable journey, the strides made by Mediterranean data centers have reshaped Europe’s tech landscape in profound ways. Their ascent from overlooked coastal cities to vital digital hubs underscores the power of strategic location and sustainable innovation. As challenges like community resistance and infrastructure limits are navigated, actionable steps emerge as the path forward. Prioritizing local engagement, investing in green energy, and capitalizing on connectivity strengths offer a blueprint for lasting impact. These efforts ensure that the region’s digital surge not only meets immediate demands but also paves the way for a resilient, equitable tech ecosystem across the continent.