The Paradox of Peak Performance Arista’s Triumph Amid a Looming Threat

Arista Networks is riding a tidal wave of success, posting a record-breaking $9 billion in revenue for 2025 on the back of the generative AI boom. With its stock soaring and market share expanding, the company appears to be an unstoppable force in high-performance networking. Yet, beneath this triumphant surface, a critical vulnerability is escalating into a full-blown crisis. A severe and worsening shortage of system memory components threatens to choke its supply chain, driving costs to “horrendous” levels. This article will dissect the duality of Arista’s current position, exploring the powerful growth drivers propelling it forward while critically examining whether this formidable memory crisis could derail its historic momentum. The analysis will cover the company’s strategic responses, from aggressive market expansion to massive procurement commitments, to determine its resilience in the face of this industry-wide challenge.

From Cloud Titan to AI Powerhouse The Foundation of Arista’s Success

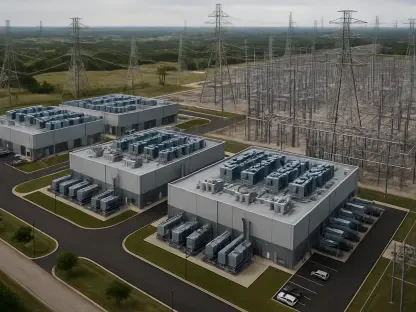

Arista’s current prosperity is not an overnight phenomenon but the result of a long-term strategy centered on high-performance, software-driven networking for the world’s largest data centers. The company built its reputation as a cloud titan by serving hyperscalers with unparalleled speed and reliability. This foundation proved to be the perfect launchpad for the AI revolution. As organizations scrambled to build massive AI training clusters, the demand for high-bandwidth, low-latency Ethernet fabrics—Arista’s specialty—exploded. This surge in demand, which CEO Jayshree Ullal calls the “Arista 2.0 momentum,” transformed the company into a critical enabler of the AI ecosystem and fueled its exceptional financial performance, including the milestone of shipping over 150 million cumulative ports. Understanding this history is crucial, as it explains both the source of Arista’s record revenue and the immense pressure now straining its supply chain.

Navigating a High-Stakes Balancing Act

The Horrendous Cost of AI Unpacking the Memory Supply Chain Crisis

Despite its financial triumphs, Arista is confronting a stark operational reality. The very AI boom fueling its growth has created an insatiable appetite for the high-performance memory used in its advanced networking switches, leading to what Ullal describes as a crisis. Prices for these critical components have not just risen; they have skyrocketed by “an order of magnitude,” forcing the company to procure memory at almost any cost to meet production demands. This is not a temporary spike but a long-term headwind expected to persist for years. In response, Arista has massively increased its purchase commitments from $4.8 billion to $6.8 billion, with a significant portion earmarked for memory. However, management concedes even this may not be enough, signaling that selective price increases on memory-intensive products may be necessary to protect gross margins from the severe financial strain.

Diversification as a Defense The Strategic Push into Campus and Routing

While battling the memory crisis on one front, Arista is proactively opening another by aggressively expanding into the campus and Wide Area Network (WAN) markets. This strategic diversification is a core pillar of its long-term growth plan, aiming to reduce its dependency on the volatile hyperscale sector. The company has set an ambitious target to grow this business segment by over 60%, from its current run rate of roughly $800 million to $1.25 billion by 2026. This push is supported by new flagship products like the 7800 R4 spine, a 460-terabit platform engineered for demanding use cases like Data Center Interconnect (DCI) and multiservice routing. By establishing a strong foothold in this adjacent market, which already contributes 18% of total revenue, Arista is building a more resilient and balanced business capable of weathering turbulence in any single segment.

Cementing Leadership Through Open Standards and Next-Gen Ethernet

At its core, Arista’s strength remains its leadership in cloud, AI, and data center networking, built upon its differentiated EOS software stack. Its portfolio of EtherLink AI and 7000 series platforms continues to set the pace for the industry, with an “imminent” migration from 800-gigabit to 1.6-terabit Ethernet speeds on the horizon. Looking further, Arista is championing the development of the Ethernet for Scale-Up Networking (ESUN) specification, a new multivendor industry standard. Ullal has emphasized that a robust, non-proprietary standard is essential for the industry’s evolution, a stark contrast to the proprietary ecosystems favored by some competitors. By aligning its future product releases with this open standard, Arista is not only future-proofing its technology but also positioning itself as a collaborative leader dedicated to fostering a more competitive and interoperable AI ecosystem.

Doubling Down on the AI Engine of Growth

Looking forward, Arista is not shying away from the very market causing its supply chain headaches; instead, it is doubling down. The company has set an audacious goal to double its AI networking revenue to $3.25 billion in 2026, a clear signal of its confidence in navigating the present challenges. A key part of this strategy involves a pragmatic approach to the market landscape. While affirming its commitment to interoperating with Nvidia, the dominant force in GPUs, Arista is simultaneously working to broaden the ecosystem. By collaborating with a diverse array of influential players in the “modern AI stack”—including AMD, ARM, Broadcom, OpenAI, and Pure Storage—Arista is helping to cultivate a more open and resilient AI infrastructure, ensuring its own growth is not tied to the fortunes of a single partner.

Strategic Imperatives in a Constrained Environment

The analysis reveals several major takeaways. First, Arista’s financial performance is exceptionally strong, driven by its indispensable role in the AI revolution. Second, this success has created a severe and potentially long-lasting memory supply chain crisis that poses a significant threat to profitability and production capacity. Third, the company is not passively accepting this fate but is actively managing it through massive financial commitments, potential price adjustments, and strategic diversification into new markets. For businesses relying on Arista, the key recommendation is to engage in proactive, long-range planning and forecasting, as lead times may lengthen and costs for specific high-memory products could rise. For investors, the challenge is to weigh the undeniable growth story against the tangible risks of a deeply constrained supply chain.

A Defining Test of Resilience

Arista Networks stood at a pivotal juncture where unprecedented demand met unprecedented supply constraints. Its journey through 2025 was a masterclass in capitalizing on the AI boom, but its success in 2026 and beyond has been defined by its ability to navigate the severe memory crisis. The core theme was one of resilience—whether Arista’s strategic planning, financial strength, and market diversification were robust enough to absorb the shockwaves from its supply chain. This situation was more than just a temporary challenge for one company; it was a case study for the entire technology sector on the hidden costs of exponential growth. Ultimately, Arista’s ability to secure its supply of critical components proved to be the ultimate test of whether it could sustain its record-breaking trajectory or if its growth engine would be throttled by the very boom it helped create.