In a landmark development that is reshaping the telecommunications and interconnect industry, Amphenol has finalized a deal to acquire CommScope’s Connectivity and Cable Solutions (CCS) business for an impressive $10.5 billion. This strategic move positions Amphenol as a powerhouse in fiber optic interconnect technologies, data center solutions, and broadband networks, building on its earlier acquisition of CommScope’s Andrew connectivity business for $2.1 billion last year. The transaction not only underscores Amphenol’s aggressive expansion strategy but also highlights the growing importance of advanced connectivity in today’s tech-driven landscape. With CCS expected to contribute $3.6 billion in annual sales, Amphenol is set to tap into high-growth markets fueled by artificial intelligence (AI) infrastructure and next-generation networks, reinforcing its competitive edge in a rapidly evolving sector.

Strategic Growth and Market Positioning

Strengthening a Dominant Presence

Amphenol’s acquisition of CommScope’s CCS business represents a pivotal moment in the company’s quest to dominate the interconnect solutions market, particularly in areas experiencing explosive growth. Valued at $10.5 billion, this deal comes on the heels of Amphenol’s record-breaking second-quarter sales of $5.7 billion, a 57% year-on-year increase driven by a mix of organic growth and strategic acquisitions. The addition of CCS, with its projected $3.6 billion in annual revenue, significantly enhances Amphenol’s ability to address the escalating demands of data centers, broadband networks, and industrial applications. This move aligns perfectly with the industry’s shift toward AI-driven infrastructure, where high-speed connectivity is paramount. By integrating CCS’s capabilities, Amphenol is not just expanding its footprint but also setting a new benchmark for comprehensive solutions in critical technology sectors.

Capitalizing on High-Growth Opportunities

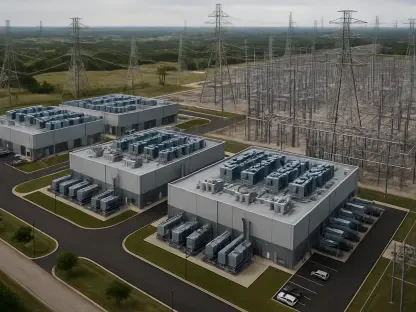

Beyond immediate financial gains, the acquisition of CCS positions Amphenol to capitalize on long-term opportunities in markets driven by technological innovation. The CCS portfolio, which spans fiber optic interconnections for data centers, broadband network solutions, and industrial interconnect tools, complements Amphenol’s existing strengths and opens new avenues for growth. Data centers alone account for 40% of CCS sales, a segment experiencing robust expansion due to the AI boom and the need for accelerated computing power. This strategic alignment enables Amphenol to offer end-to-end solutions that meet the complex needs of modern infrastructure. Furthermore, with broadband networks and smart industrial systems also forming significant portions of CCS revenue, Amphenol is well-equipped to address diverse connectivity challenges across multiple industries, ensuring sustained relevance in a competitive landscape.

Technological and Portfolio Expansion

Advancing Fiber Optic Capabilities

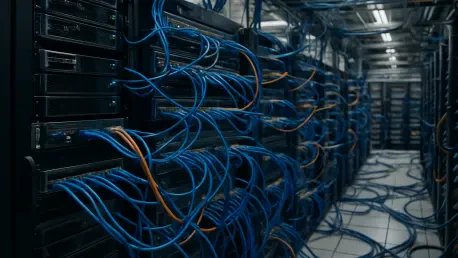

A key driver behind Amphenol’s acquisition of CommScope’s CCS business is the transformative boost it provides to the company’s fiber optic expertise. Amphenol President and CEO R. Adam Norwitt emphasized that while the company has an existing presence in this space, the CCS acquisition marks a substantial leap in both competency and capability. The CCS unit brings a robust portfolio of cables, connectors, complex cable assemblies, and fiber management systems—components that are essential for modern communication networks and data centers. This enhancement allows Amphenol to deliver a more complete solution to customers, covering high-speed copper interconnects alongside advanced fiber optic systems. As digital infrastructure continues to evolve, this expanded technological prowess positions Amphenol to meet the intricate demands of next-generation connectivity with unparalleled precision.

Diversifying Market Reach

The acquisition also diversifies Amphenol’s market reach by integrating CCS’s segmented sales structure, which targets critical and varied sectors. Specifically, 40% of CCS revenue comes from data center fiber optic interconnections, a segment poised for significant growth amid rising AI and cloud computing demands. Another 35% is derived from broadband network solutions, addressing the need for reliable connectivity in urban and rural settings alike, while the remaining 25% focuses on industrial interconnect tools for smart buildings and factories. This balanced distribution not only mitigates risk by spreading revenue across multiple streams but also aligns with Amphenol’s strategic focus on data centers and network infrastructure. By incorporating these diverse capabilities, Amphenol can cater to a broader customer base, from tech giants building massive data hubs to industrial firms modernizing their operations with smart technology.

Industry Trends and Market Dynamics

Meeting the Surge in Connectivity Needs

The acquisition of CCS by Amphenol reflects broader industry trends where the demand for advanced interconnect solutions is surging, driven by transformative technologies like AI, cloud computing, and 5G networks. Data centers, which form the largest revenue segment for CCS, are at the forefront of this growth as organizations invest heavily in infrastructure to support AI applications and accelerated computing environments. The need for scalability and high performance in these facilities has made fiber optic technologies indispensable, a reality that Amphenol is now better positioned to address. This deal highlights how companies are racing to meet the connectivity requirements of a digital-first world, where seamless data transfer and robust network systems are no longer optional but essential for progress across industries.

Navigating a Consolidating Sector

Another significant trend underscored by this acquisition is the ongoing consolidation within the telecommunications and interconnect industry, as firms seek to bolster their capabilities through strategic mergers and purchases. Amphenol’s move to acquire CCS exemplifies how companies are opting to gain expertise, market share, and intellectual property rapidly rather than relying solely on internal development. This approach allows for quicker adaptation to market shifts and customer needs, particularly in high-growth areas like 5G and smart infrastructure. As competition intensifies, such consolidations enable players like Amphenol to integrate diverse technologies and business units, creating comprehensive offerings that stand out in a crowded field. This trend of strategic alignment through acquisitions is likely to shape the industry’s future, with connectivity remaining a central focus.

Integration and Relationship Building

Building on a Foundation of Trust

A notable aspect of Amphenol’s acquisition of CommScope’s CCS business is the foundation of trust and familiarity established through prior dealings, particularly the $2.1 billion purchase of CommScope’s Andrew connectivity business last year. That earlier transaction provided valuable insights into CommScope’s operations, technology, and workforce, fostering confidence in the potential for a smooth integration of CCS’s 15,000 employees. Amphenol’s leadership has expressed optimism about leveraging this established relationship to ensure operational synergy. The focus on maintaining a positive rapport during the transition period, expected to conclude by the first half of 2026 pending regulatory approvals, signals a strategic approach to minimizing disruptions while maximizing the benefits of this substantial acquisition.

Prioritizing Talent and Culture

Beyond operational logistics, Amphenol places a high priority on the human element of this acquisition, recognizing the value of CCS’s talent pool as a driver of future success. CEO R. Adam Norwitt has publicly lauded the “outstanding technology and deep bench of talent” within CommScope, indicating that cultural and professional alignment will be central to the integration process. This emphasis on talent retention and development suggests a commitment to harnessing the expertise of CCS employees to innovate and enhance Amphenol’s offerings. By fostering an environment where skills and ideas can thrive, Amphenol aims to not only preserve the strengths of the acquired unit but also build a cohesive team capable of tackling the challenges of a dynamic market, ensuring long-term growth and stability post-acquisition.

Broader Growth Strategy

Pursuing Expansion Through Acquisitions

Amphenol’s acquisition of CommScope’s CCS business fits into a broader pattern of growth driven by strategic acquisitions, a tactic that has consistently fueled the company’s expansion. Alongside the CCS deal, recent purchases such as PCTel, focused on antenna and test equipment, and Narda-MITEQ, specializing in radio frequency components for defense, demonstrate Amphenol’s intent to diversify its portfolio across multiple high-growth sectors. These moves, combined with the earlier CommScope Andrew acquisition, have contributed to a remarkable 57% year-on-year sales increase, with a significant portion attributed to such strategic integrations. This approach allows Amphenol to quickly adapt to emerging market needs, ensuring it remains a leader in interconnect solutions by continuously broadening its technological and operational scope.

Setting Sights on Future Innovation

Looking ahead, Amphenol’s commitment to an acquisition-driven strategy signals a clear focus on future innovation and market leadership, with the CCS deal serving as a cornerstone of this vision. By consistently integrating complementary businesses, Amphenol not only enhances its current offerings but also positions itself to anticipate and shape industry trends over the coming years. The emphasis on sectors like AI infrastructure, 5G networks, and industrial connectivity through these acquisitions reflects a proactive stance on addressing tomorrow’s challenges today. As the company navigates the integration of CCS in the coming stages, it lays the groundwork for sustained growth, reflecting on how each acquisition builds toward a more robust, versatile portfolio. The focus now shifts to leveraging these combined strengths to drive innovation, ensuring that Amphenol continues to set the pace in a competitive field.